Car Repossessions Surge 23% as Americans Fall Behind on Payments

https://www.bloomberg.com/news/articles/2024-07-16/car-repossessions-surge-23-as-americans-fall-behind-on-payments-lyoklofbPaywall removed https://archive.is/NFELy

Paywall removed https://archive.is/NFELy

cross-posted from: https://lemmy.world/post/17889213 ... read full post

Yes, I do have a full-time job, and I even enjoy it, but it doesn't pay enough to survive in this hellscape of a world we live in. I lack the college degree required to get almost any decent-paying job (plus my last job hunt took MONTHS to get a lead), I don't have the skills or originality to become an online content creator, nor the artistry or patience to create and sell trinkets on Etsy (plus, that would require an initial investment which I simply do not have). Should I set up a GoFundMe? OnlyFans? I wouldn't really be offering anything except a charity basket/collection plate so that feels dishonest at best. Idk, I'm quite literally having a breakdown because I'm probably going to lose my car soon, and then my job, and then my apartment, and then my life. Any help at all would be appreciated. Thank you ... read full post

The potential charges, says Marianne Lake, CEO of consumer and community banking at JPMorgan, are a result of new regulatory rules that cap overdraft and late fees. Lake says Chase will be passing along those increased expenses to customers, which would put an end to now-free services such as checking accounts and wealth management tools. And she says she expects other banks will follow suit.

I'm in an extremely fortunate position where my Mom, upon learning about current mortgage rates and why I haven't bought a house yet, wants to essentially be my bank to buy a house. As in, she wants to fund the house, put it in my name, and I pay her a reasonable down payment and pay a "mortgage" to her at 2-3%. So what would be the best way to do this?She buys the house then transfers the deed? Should she just transfer the cash and I purchase it? ... read full post

They are keeping this quiet, but this affects 2.9% of US bank customers.

The US government is telling everybody that inflation is 3.4% per year. That is not correct. Try 14.2% and that's about right. Source : gold/usd 1 year simple moving average.

I wanted to start using a budgeting program to better organize my spending/ goals, and basically narrowed it down to 3 --YNAB, Actual and Quicken Simplifi. ... read full post

I'm looking for the top European bank that doesn't block your funds without reason. For instance, many individuals have reported online that Revolut has blocked their accounts suddenly and sometimes for various months.

Hello, ... read full post

How would you go about selecting a Certified Financial Planner? ... read full post

cross-posted from: https://lemmygrad.ml/post/4352701

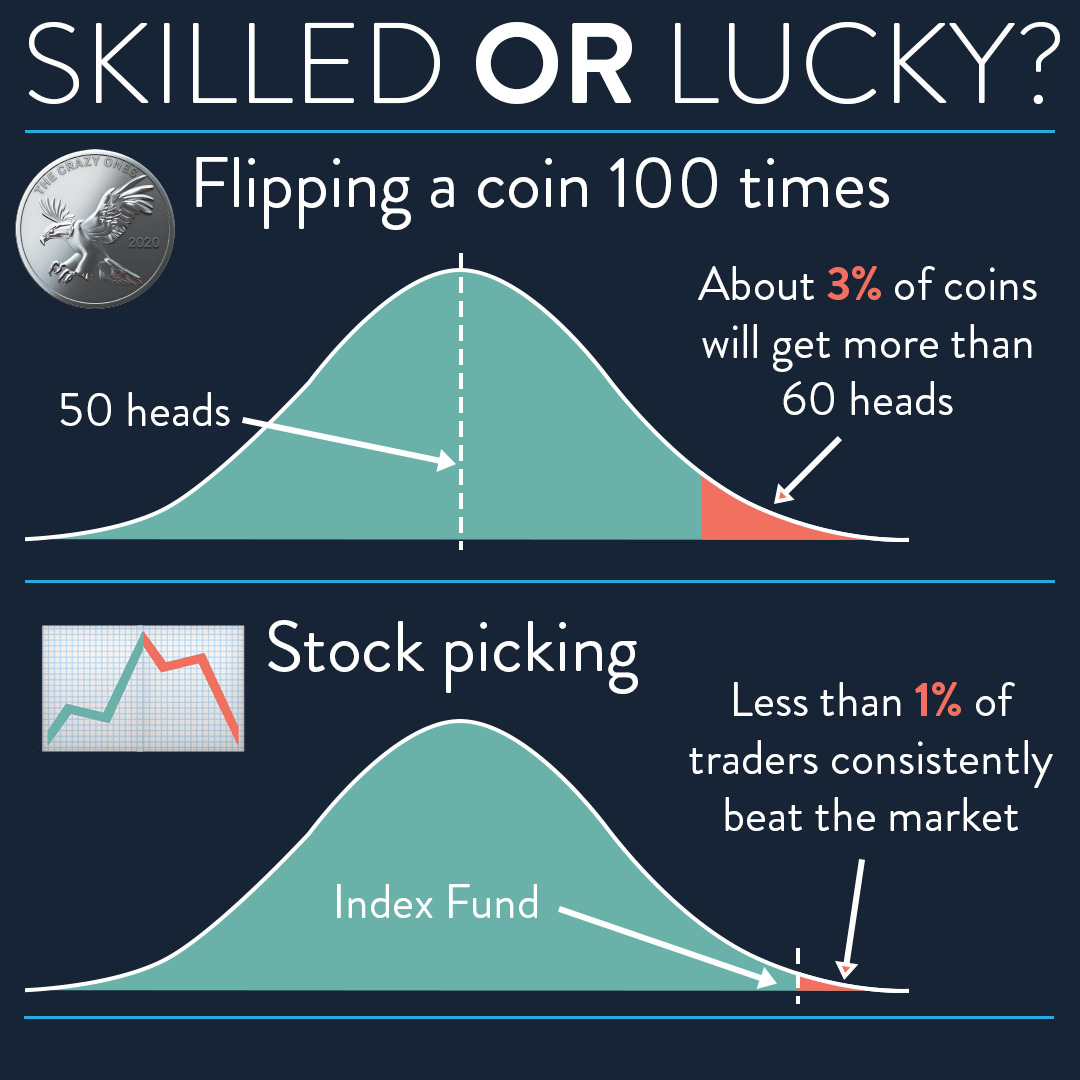

Beating the market

cross-posted from: https://lemmygrad.ml/post/4307103

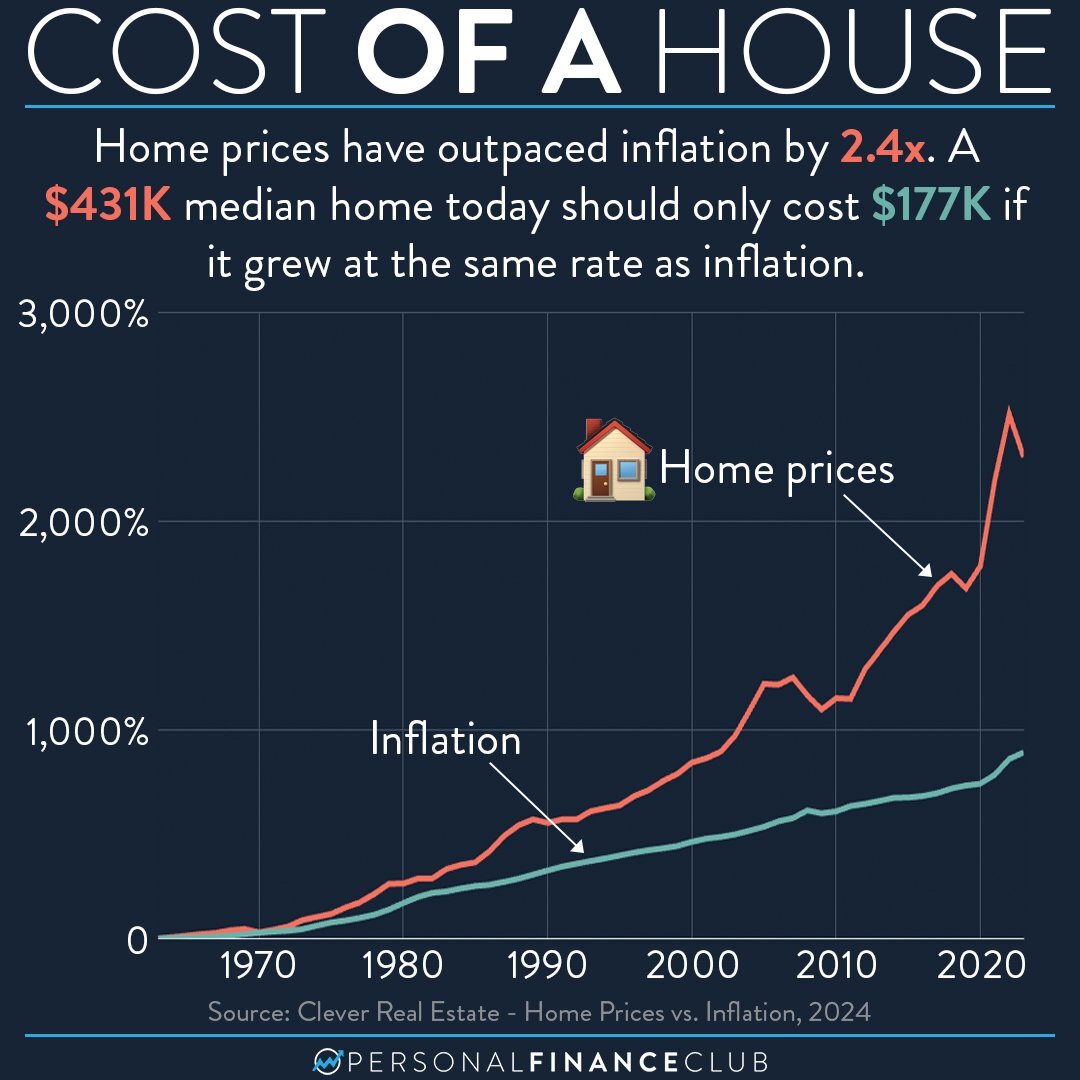

Home prices have outpaced inflation by 2.4 times